Loomis Sayles Discovery Index

Designed to drive results in both growth and fragile market conditions

The Loomis Sayles Discovery Index (the “Index”) is a growth-oriented index designed to identify the current market environment and reallocate to assets with the aim of providing stable and consistent long-term appreciation through changing markets. It features:

Broad diversification

The Index leverages a combination of U.S. growth and value equities, short-term fixed income futures, and commodity futures to offer a broad range of assets for diversification.

Forward-looking framework

Using a predictive forecasting methodology, the Index aims to identify the current market environment and dynamically reallocate between growth and value equities to the equity style that tends to perform best during those periods.1

Dynamic optimization

The Index allocates to U.S. equities and two alternative strategies with low correlation aiming to capture returns across various equity and rate environments.

Helpful Resources

Broadly diversified strategies to smooth and seek potential returns

The Loomis Sayles Discovery Index seeks to offer opportunities for growth through an equity strategy, global rates alternative strategy and a commodities alternative strategy. The Index features 23 underlying assets amongst three asset classes that provide the flexibility to adapt to a variety of market environments.

U.S. Equity Strategy

The U.S. Equity Strategy is composed of the U.S. Large Cap Growth Index and U.S. Large Cap Value Index. The Strategy reallocates daily between growth and value equities aiming to drive returns in all market conditions.

Global Rates Alternative Strategy

The Global Rates Alternative Strategy is composed of 17 futures based rates indices. These include short-term rates across the United States, Europe and the United Kingdom. The Strategy optimizes daily to reduce sensitivity to changing interest rates.

Commodities Alternative Strategy

The Commodities Alternative Strategy aims to generate positive returns during inflationary periods by taking long exposure to long-dated commodity futures while also taking short exposure to short-dated commodity futures.2

Loomis’ proprietary forecasting methodology

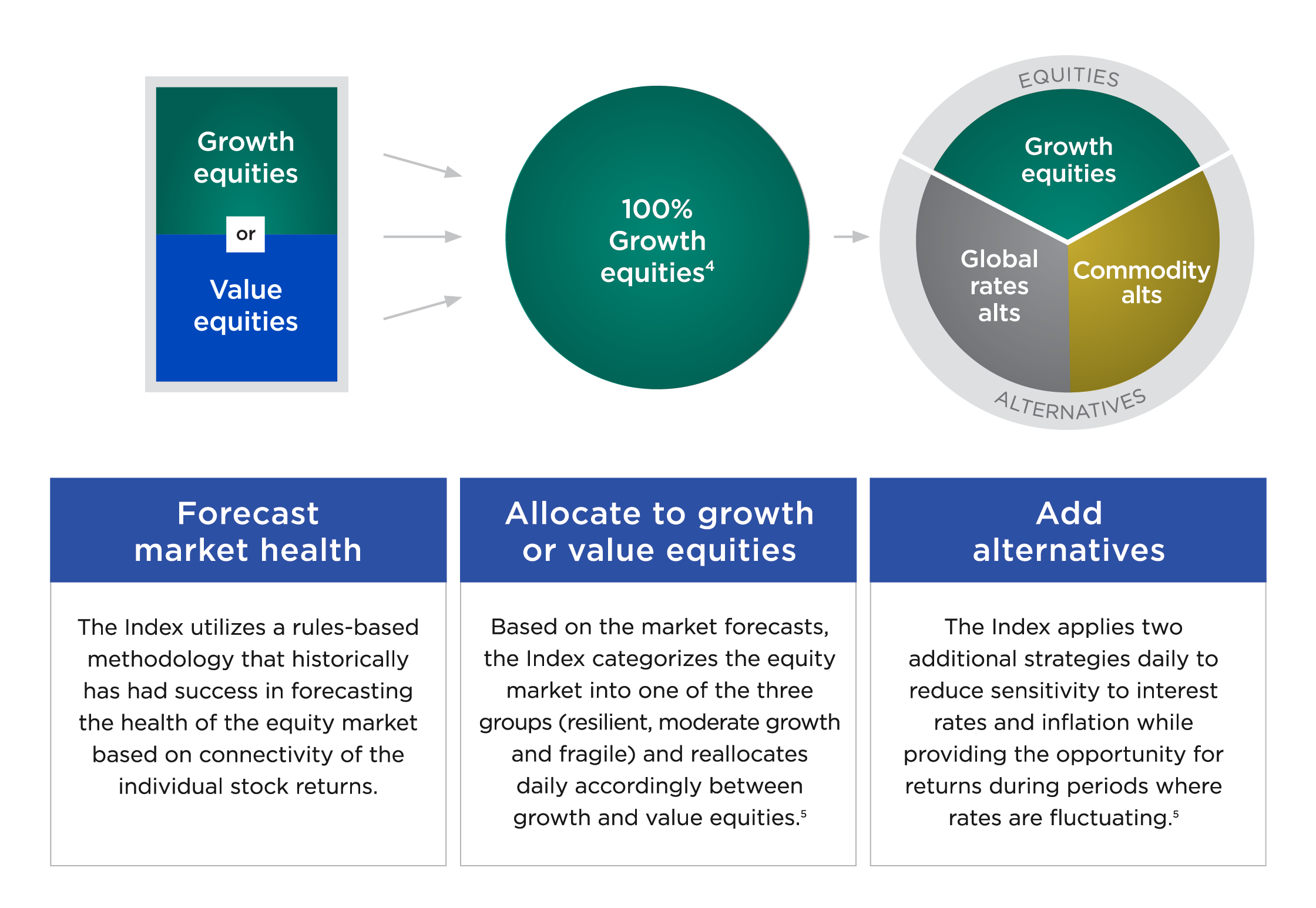

The Index is designed to forecast the current equity market using a predictive methodology that historically has had success in discovering the health of the equity market.3 It determines whether equities are in a resilient, moderate growth or fragile market. Based on the equity market, the Index reallocates between growth and value equities.

Resilient market

Moderate growth market

Fragile market

Dynamic optimization process leveraging market forecasts

The Loomis Sayles Discovery Index dynamic equity reallocation process between growth and value equities provides the ability to generate returns from the equity style that tends to perform best during various market environments. The Index then applies two additional strategies to help reduce interest rate risk and combat inflation.

The Loomis Sayles Discovery Index rebalances daily to meet its 8% volatility control target level. This daily re-allocation aims to further reduce risk when markets are volatile. While this can lessen the impact of market downturns, it may also limit upside potential.

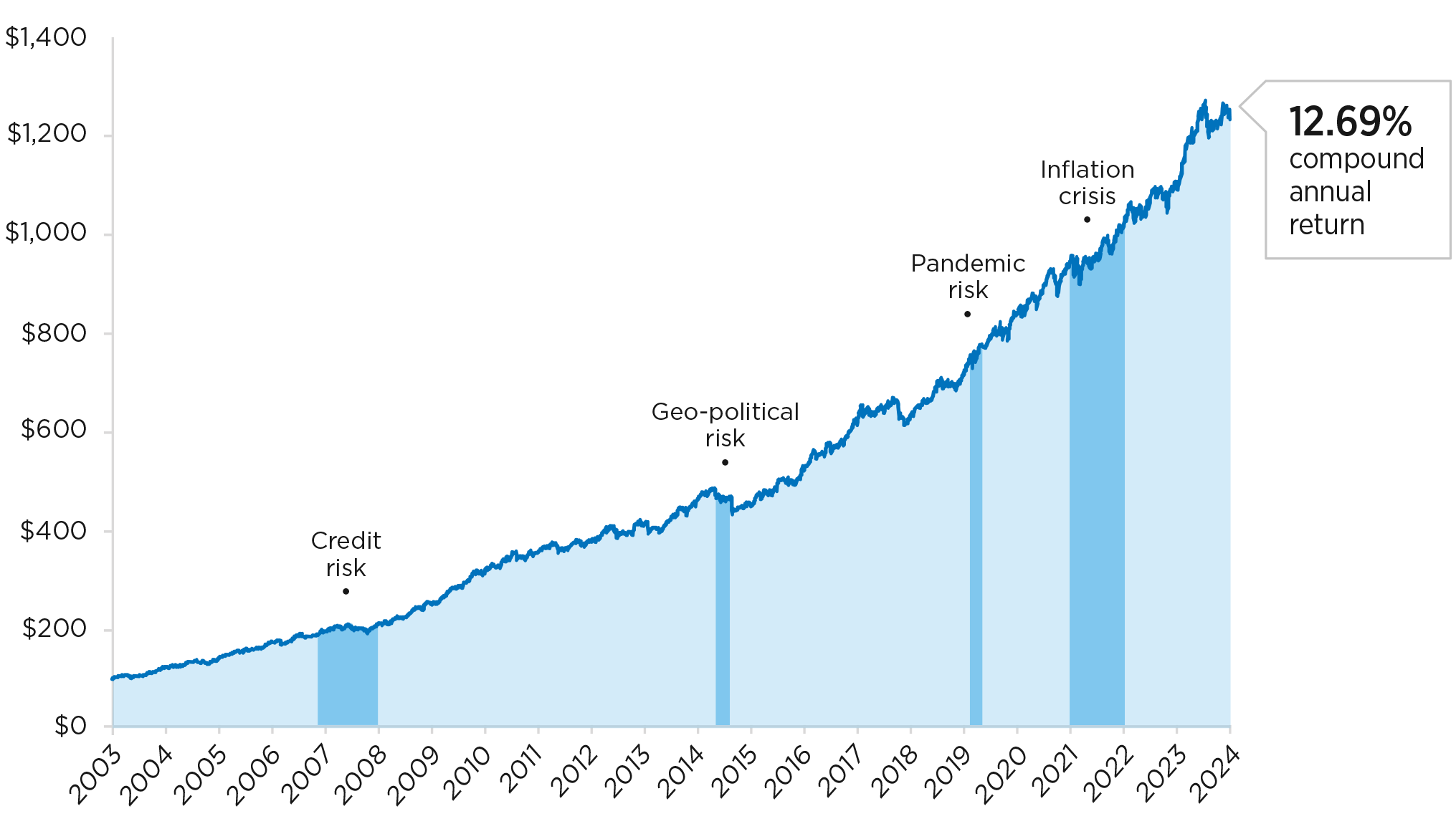

Consistent long-term growth opportunities

Based on back-tested data, the Index would have provided steady growth through a variety of market environments due to its forecasting, dynamic reallocation and risk mitigation strategies. It is important to note that the graph below shows the hypothetical performance of the Index using back-tested data. Back-tested data is not indicative of future results.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

New Heights Select does not directly participate in the stock market or any index. It is not possible to invest in an index. Withdrawals are subject to income tax, and withdrawals before age 59½ may be subject to a 10% federal tax penalty. Annuities have limitations. They are long-term vehicles designed for retirement purposes. They are not intended to replace emergency funds, to be used as income for day-to-day expenses or to fund short-term savings goals. Please read the contract for complete details. Guarantees and protections are subject to the claims-paying ability of Nationwide Life and Annuity Insurance Company.

The investment strategy implemented by the Loomis Sayles Discovery Index, the Citi Loomis FI VT Index and the Citi Loomis VT Index has been developed by Loomis, Sayles & Company, L.P. These indices are administered and published by Citigroup Inc. or its affiliates.

The Loomis Sayles Discovery Index provides a notional exposure to the base index from which it is derived (i.e. the Citi Loomis FI VT Index) which is adjusted to reflect a notional fee of 0.50% (a “Fee Inclusive Index”). The level of a Fee Inclusive Index is the level of its base index (i.e. the Citi Loomis VT Index) minus the notional fee. This deduction of notional fees is made daily. Some of the constituents of the Loomis Sayles Discovery Index (which are themselves indices) may also deduct notional costs (whether notional fees, notional replication costs, notional roll-over costs or notional transaction costs) in respect of their own constituents. The cumulative effect of these notional fees and costs may be significant and will adversely affect the performance of the Loomis Sayles Discovery Index. Risks which arise in respect of indices, including factors which can affect index performance and index constituents, are discussed in the index conditions.

Citi is a registered trademark and service mark of Citigroup Inc. or its affiliates (collectively, “Citigroup”, which shall include their respective directors, officers, employees, representatives, delegates or agents) and is used and registered throughout the world. The Loomis Sayles Discovery Index (the “Index”) is administered and published by Citigroup, which has contracted with Loomis, Sayles & Company, L.P. (“Loomis Sayles”, which shall include its respective directors, officers, employees, representatives, delegates or agents) to provide intellectual property (the “IP”) that is used by Citigroup for the construction and design of the Index. Certain other third parties (together, “Third-Party Data Provider”) have contributed data or IP for use in the Index. Loomis Sayles is a trademark of Loomis, Sayles & Company, L.P. registered with the US Patent and Trademark Office. The trademarks Citi and Loomis Sayles are being utilized under license and agreement. Nationwide Life Insurance Company and Nationwide Life and Annuity Insurance Company (“Nationwide”) has entered into a sublicense agreement with Citigroup providing for the right to utilize the Loomis Sayles trademarks in connection with Nationwide New Heights® Select (the “Financial Product”). Neither Citigroup, acting in the capacity of index administrator (the “Index Administrator”) and/or index calculation agent (the “Index Calculation Agent”) in relation to the Index nor Loomis Sayles nor Third-Party Data Provider makes any express or implied representation or warranty as to (1) the advisability of purchasing the Financial Product; (2) the level(s) of the Index at any particular time on any particular date; (3) the results to be obtained by any investor in the Financial Product or any other person or entity, from the use of the Index or any data included therein for any purpose; (4) the merchantability or fitness for a particular purpose of the Index; or (5) any other matter. The Financial Product is not designed, sponsored, endorsed, sold, underwritten, distributed, promoted or administered by Citigroup, Loomis Sayles or Third-Party Data Provider, and none of them is in any way responsible for the Financial Product or the outcomes of the Financial Product. Loomis Sayles, Citigroup, and Third-Party Data Provider hereby expressly disclaim, to the fullest extent permitted by applicable law, all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to the Index. Neither Loomis Sayles nor Citigroup nor Third-Party Data Provider guarantees the accuracy, timeliness or completeness of the Index or the IP, as applicable, or any data included therein or the calculation thereof or any communications with respect thereto. Citigroup, Loomis Sayles, and Third-Party Data Provider expressly disclaim any and all liability of whatever nature for any losses, damages, costs, claims and expenses (including but not limited to any special, punitive, direct, indirect or consequential damages, lost income or lost profits or opportunity costs) arising out of matters relating to the use of the Index, the IP or the Financial Product, as applicable, even if notified of the possibility of such damages. Neither the Index Administrator nor the Index Calculation Agent is under any obligation to continue the calculation, publication and dissemination of the Index nor shall they or Loomis Sayles or Third-Party Data Provider have any liability for any errors, omissions, interruptions or delays relating to the Index. Citigroup, Loomis Sayles, and Third-Party Data Provider shall each act as principal and not as agent or fiduciary of any other person. Neither Loomis Sayles nor Citigroup nor Third Party Data Provider has published or approved this document and does not accept any responsibility for its contents or use.

During the normal course of its business, Citigroup may enter into or promote, offer or sell transactions or investments (structured or otherwise) linked to any Index and/or any of its constituents. In addition, Citigroup may have, or may have had, long or short principal positions and/or actively trade, by making markets to its clients, positions in or relating to any Index or any of its constituents, or may invest or engage in transactions with other persons, or on behalf of such persons relating to any of these items. Citigroup may also undertake hedging transactions related to the initiation or termination of financial products or transactions, which may adversely affect the market price, rate or other market factor(s) underlying any constituent or any Index. Citigroup may have an investment banking or other commercial relationship with and access to information from the issuer(s) of constituents. Such activity may or may not have an impact on the level of any Index, but potential investors and counterparties should be aware that a conflict of interest could arise where anyone is acting in more than one capacity, and such conflict may have an impact (either positive or negative) on the level of any Index.

The Index (including the methodology(ies) and formula(s) therefor) has been designed and is compiled, calculated, maintained and sponsored without regard to any financial products that reference the Index (including the Financial Product), any licensee, sub-licensor or sub-licensee of the Index, any client or any other person. Loomis Sayles and Citigroup may also transact in assets referenced in the Index (or in financial instruments such as derivatives that reference those assets), including those which could have a positive or negative effect on the value of the Index and the Financial Product.

The Index is described in full in the Index Conditions which are available upon request. The Index is proprietary and confidential to the Index Administrator. No person may use the Index in any way or reproduce or disseminate information relating to the Index without the prior written consent of the Index Administrator. The Index is not in any way sponsored, endorsed or promoted by the issuer or sponsor of any of its constituents.

The Loomis Sayles Discovery Index is an excess return index. Indexes calculated on an excess return basis include calculation elements that reduce index performance. Because of this, an excess return version of an index will have lower performance than a total return version of the same index would, especially in high interest rate environments. Some excess return indexes also deduct a notional charge(s) in calculating index performance. This deduction(s) will reduce the potential positive change in index performance and increase the potential negative change in the index performance.

Nationwide New Heights® Select, an individual, single purchase payment, deferred fixed indexed annuity is issued by Nationwide Life and Annuity Insurance Company, Columbus, Ohio.

Nationwide, the Nationwide N and Eagle, Nationwide is on your side, and Nationwide New Heights are service marks of the Nationwide Mutual Insurance Company. © 2025 Nationwide

ICC20-FACC-0126AOPP, ICC23-FAZZ-0150AO.1